Capitalization rate, commonly known as cap rate, is a fundamental metric used by real estate investors to assess the potential return on investment of a property.

It represents the ratio of a property’s net operating income to its current market value or purchase price.

Understanding the cap rate can help you gauge the profitability of real estate investments and compare the attractiveness of various properties in different markets or segments.

Key Takeaways

Overview

When you’re looking to invest in real estate, understanding the cap rate is crucial. It’s a tool to gauge a property’s profitability and risk.

Definition of Cap Rate

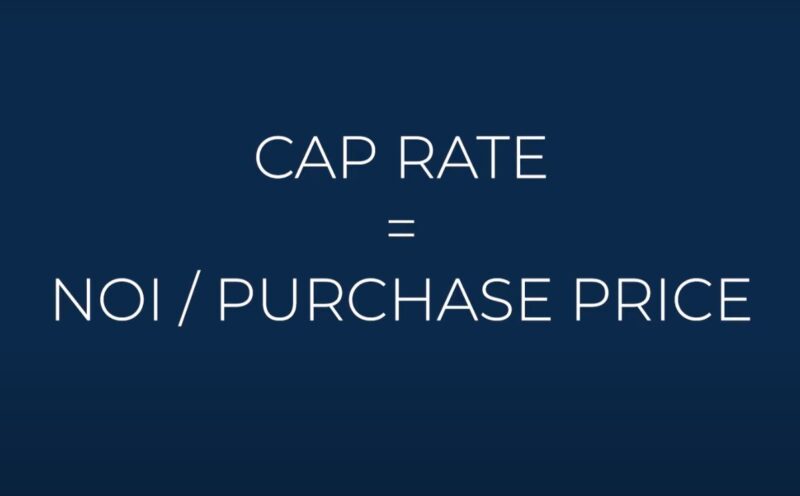

The capitalization rate, or cap rate, is a formula that helps you assess the return on your investment from a property. Specifically, it is the ratio of a property’s annual net operating income (NOI) to its purchase price. To put it simply, the cap rate equates to the yield of a property over a one-year time frame when bought with cash.

Relevance in Real Estate

In real estate, the cap rate is pivotal for estimating the potential return on an investment. It aids in comparing various properties before purchase. The cap rate is also indicative of the investment risk; a higher cap rate might imply a higher potential return but also higher risk, while a lower cap rate could suggest a more stable investment. Understanding how to tell good cap rates from bad ones is essential in making profitable investment decisions.

Calculating Cap Rate

Cap rate is a fundamental metric in real estate investment, providing insight into the potential return on an investment property. It is crucial to understand how to calculate the cap rate accurately to assess the profitability of real estate opportunities.

Formulas and Components

The capitalization rate (cap rate) is the ratio between a property’s net operating income (NOI) and its current market value. Here is the standard formula:

- Cap Rate = (NOI / Current Market Value) * 100

The components essential for this calculation are:

- Net Operating Income (NOI): This is the annual income generated by the property after deducting all operational expenses, such as management fees, property maintenance, taxes, and utilities.

- Current Market Value: This reflects the price at which a property would sell under current market conditions.

It’s important to note that the cap rate does not account for mortgage payments or capital expenditures.

Examples and Case Studies

Example 1: Imagine an investment property with an NOI of $20,000 and a market value of $250,000.

- Calculation: Cap Rate = ($20,000 / $250,000) * 100 = 8%

Example 2: Consider another property that generates an NOI of $50,000, with a current market value of $800,000.

- Calculation: Cap Rate = ($50,000 / $800,000) * 100 = 6.25%

These examples illustrate how varying NOIs and market values affect the cap rate. By examining real estate investment case studies, you can observe how cap rates indicate the investment’s potential and guide decision-making.

Cap Rate Applications

Cap rate, or capitalization rate, is a fundamental metric in evaluating the potential success of real estate investments. It offers a snapshot of property income relative to its market value, guiding your investment decisions effectively.

Investment Analysis

When you analyze potential real estate investments, the cap rate is instrumental in revealing the yield of a property over one year. It shows you the expected return on investment (ROI) without the influence of financing, providing a pure comparison of profitability across different properties.

Property Valuation

Your real estate’s market value can be estimated by using the cap rate. Particularly in commercial real estate, if you know the average cap rate for the type of property in a specific location, applying it to your property’s net operating income (NOI) furnishes a useful estimate of its value.

Comparative Analysis

Cap rate empowers you to compare real estate investments in varying markets or segments. By examining properties with different cap rates, you can assess which might offer higher returns or pose less risk, thus aligning with your investment strategy and risk tolerance.

Advantages of Using Cap Rate

When you’re assessing real estate investments, using the capitalization rate (Cap Rate) can offer you several clear advantages.

Firstly, the Cap Rate provides you with a quick, initial assessment of a property’s potential return. You can compare the Cap Rate across various properties to efficiently identify which ones may yield better returns. Specifically, it functions as a benchmark to evaluate different investment opportunities within the realm of real estate.

Another key advantage is that Cap Rate helps you understand the risk involved with a particular investment. Traditionally, a higher Cap Rate may indicate a higher risk, while a lower Cap Rate could suggest a less risky investment.

Moreover, Cap Rate calculations do not account for your mortgage financing, presenting an unleveled picture of the investment performance. This allows you to evaluate the property purely on its income-generating potential, independent of how you finance the purchase.

It’s also beneficial for comparative analysis. When you look at the Cap Rate in conjunction with other metrics such as location, property condition, and market trends, you’re able to make more informed decisions.

Considerations and Limitations

When evaluating real estate investments using cap rate, it’s essential to understand that this metric isn’t a one-size-fits-all solution. Here are some key factors you need to consider:

- Market Variability: Cap rates fluctuate with the real estate market, and what may be considered a good rate in one region or sector might not hold the same value in another.

- Property Type: Different types of properties, whether commercial or residential, have varying operational costs and revenue potentials, influencing the cap rate.

- Interest Rates: An increase in interest rates can affect property values and, consequently, the cap rate.

The limitations of using cap rate include:

- Not Accounting for Financing: Cap rate calculations do not reflect mortgage costs; if you have high-interest financing, a good cap rate may not assure profitability.

- Ignoring Future Costs: Cap rates do not factor in future capital expenditures or changes in operational costs.

- Overlooking Growth Potential: A property with a lower cap rate might offer higher growth potential than one with a high cap rate.

| Factor | Impact on Cap Rate |

|---|---|

| Market trends | Can cause significant variation |

| Property specifics | Determines operating efficiency |

| Economic conditions | Influences value and revenue potential |

Remember, a cap rate is a static measure and does not reflect changes over time. You must combine it with other financial metrics and in-depth market analysis for a comprehensive evaluation of a real estate investment’s potential.

Frequently Asked Questions

How is capitalization rate (cap rate) calculated in real estate?

To compute the cap rate, you divide the Net Operating Income (NOI) by the property’s current market value. For example, if your property’s NOI is $15,000 and the market value is $200,000, your cap rate is 7.5%.

What constitutes a favorable cap rate for residential rental properties?

A favorable cap rate varies by market conditions and location, but in general, a cap rate between 4% to 10% can be considered good for residential rental properties, indicating a worthwhile investment.

Can you describe the differences between cap rates for commercial and residential real estate investments?

Commercial real estate typically offers higher cap rates compared to residential investments due to increased risk and longer lease contracts, which provide a more stable income stream.

What factors influence the cap rate of a property?

Several factors affect a property’s cap rate, including location, property type, interest rates, rental income stability, and growth potential in the area’s property values.

How does cap rate relate to the risk and return profile of a real estate investment?

The cap rate inversely relates to the investment’s risk level; a higher cap rate generally implies higher risk and potentially higher returns, while a lower cap rate indicates lower risk and returns.

What role does cap rate play in assessing the profitability of an investment property?

Cap rate is a crucial indicator of potential profitability, helping you evaluate the expected return on an investment property independent of financing and future property value changes.

Conclusion

The capitalization rate, or cap rate, is an indispensable metric for anyone involved in real estate investment. It offers a snapshot of a property’s potential return on investment, providing a straightforward way to compare different properties and markets. While cap rate is a valuable tool in assessing the profitability and risk of real estate investments, it’s important to remember that it should be used in conjunction with other analyses and metrics.